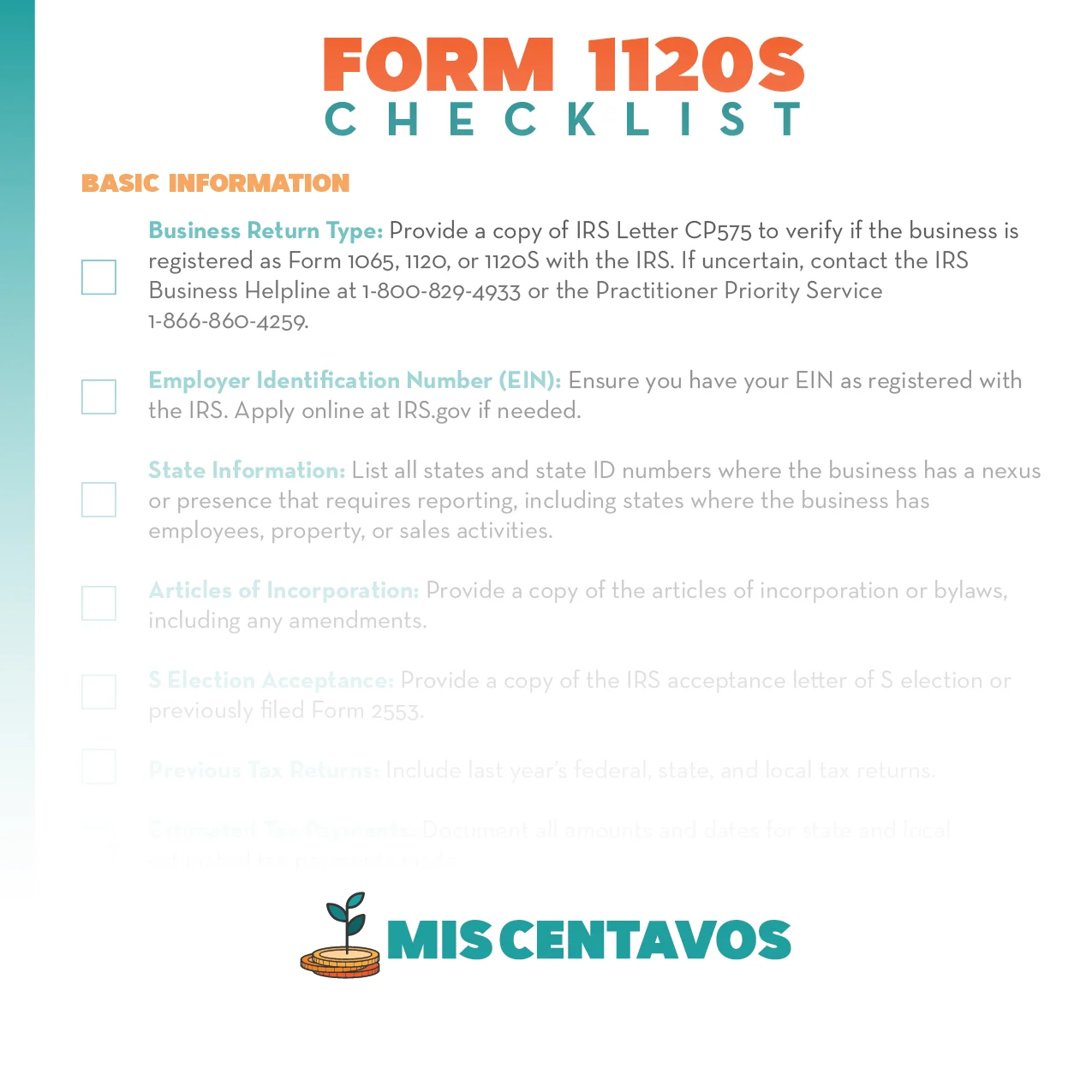

Form 1120S Tax Preparation Checklist

This 1120S Tax Preparation Checklist provides a detailed guide to help businesses organize the necessary documents for filing their 2023 taxes. From basic company details to shareholder information, business financial records, and asset reports, this checklist ensures you’re fully prepared. Don’t miss key deadlines: March 15, 2024, for calendar year filers and September 15, 2024, for extensions. Use this checklist to streamline the process and ensure compliance with IRS regulations.

$14.99

Related Products

Related products

-

Checklists

Form 1065 Tax Preparation Checklist

$14.99Original price was: $14.99.$0.00Current price is: $0.00. Add to cart