Tax Forms Boot Camp: LLCs, Partnerships, and S Corporations (TFBC) Live Webinar

Struggling with complex business tax returns or dont know how to file?

Have you found yourself outsourcing corporate tax returns because they seem too complicated? Instead of relying on another tax professional, why not build the skills to handle them yourself? Our Business Tax Forms Bootcamp course breaks down everything you need to know—from stock distributions to S-corporations—so you can confidently manage corporate clients on your own. No more missed opportunities.

Register Today!

$329 EARLY BIRD REGISTRATION!

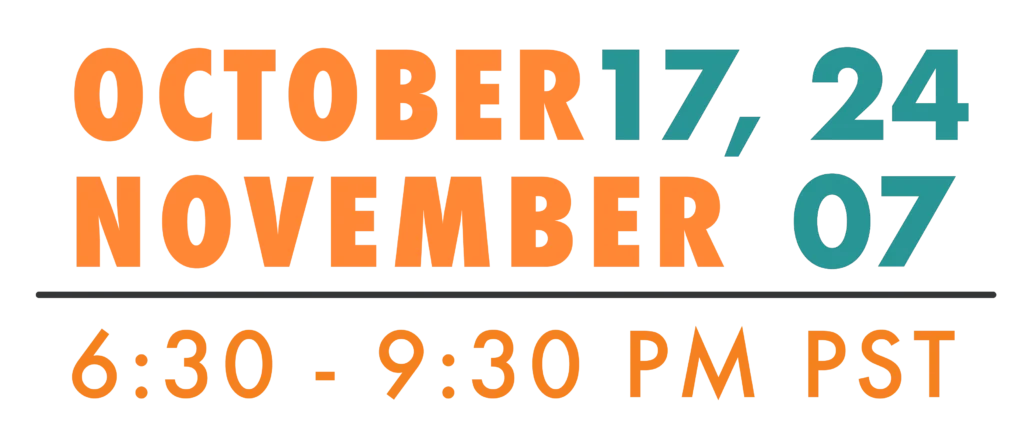

Save the date

Learn the essentials of filing business taxes

Learn in detail about the preparation of Form 1120S, Schedules M-1, K, and K-1

Learn in detail about the preparation of Form 1065, Schedules M-1, K, and K-1

Identify and handle commonly found S corporation and partnership tax issues

Elevate Your Skills with Expert-Led Education

Our speakers are top-tier professionals with extensive experience and deep knowledge in the field. They are committed to delivering high-quality education that will empower you to take your skills and business to the next level.

Stay tuned! We have more exciting speakers to announce soon—each one bringing unique insights and expertise that will add even more value to your learning experience.

Details coming soon!!

Anita Monrroy,

CPA, EA, MST

With a strong foundation in tax, Anita honed her skills working at Ernst & Young, a Big Four accounting firm. From there, she moved on to work with various small to mid-sized accounting firms where she focused on audits and tax returns for a diverse set of clients.

Details coming soon!!

Master Business Tax Returns and add more value to your practice!

Tax Forms Boot Camp: LLCs, Partnerships, and S Corporations (TFBC) Webinar

The course provides a comprehensive, hands-on, pencil pushing understanding of the preparation of both S corporation and partnership/LLC tax returns, along with the underlying laws, regulations, etc. The course uses the basic concepts underlying the two main types of business returns: 1120S and 1065 as building blocks for more complex concepts tax preparers should be aware of.

$329.00 Early Bird Registration

Partnerships, LLCs, and S Corps

Compare and contrast the tax consequences, opportunities, and pitfalls of operating a business as a partnership, LLC, or S corporation

Navigating Form 7203 for S Corporation Shareholders

Form 7203, S Corporation Shareholder Stock and Debt Basis Limitations

Handling Special Pass-Through Items in Business Taxation

Recognize and properly handle special pass-through items of income and expense

Understanding Schedules K-2 and K-3 Reporting

Reporting Requirements for Schedules K-2 and K-3

Mastering S Corporation Tax Laws and Return Preparation

Gain a comprehensive understanding of income tax laws for S corporations from eligibility and election to tax return preparation, stock basis, and loss limitation issues

Accurate S Corporation Tax Return Preparation

Accurately prepare S corporation returns and reconcile book income to taxable income

How it Works

01

SIgn Up for the Waitlist

Click the "Join Waitlist" button and enter your details

02

Get Notified

You’ll receive an email notification as soon as enrollment opens. ACT FAST! Limited spots available!

03

Enroll

Once notified, follow the link to secure your spot in the course!

Register Today!

Presented by: